The fresh USDA also offers a program called the RD otherwise Rural Creativity financing

Last night, we established a bonus from $0

July 7, 2024What’s the Difference in Signature loans and you may Secured loans?

July 7, 2024While this zero bucks off system is a great system, it is just open to Pros as well as their partners

If you’re a first time Domestic Consumer otherwise have to purchase a home with little to no or no currency down, here are a few financial programs available to you from inside the The new Hampshire.

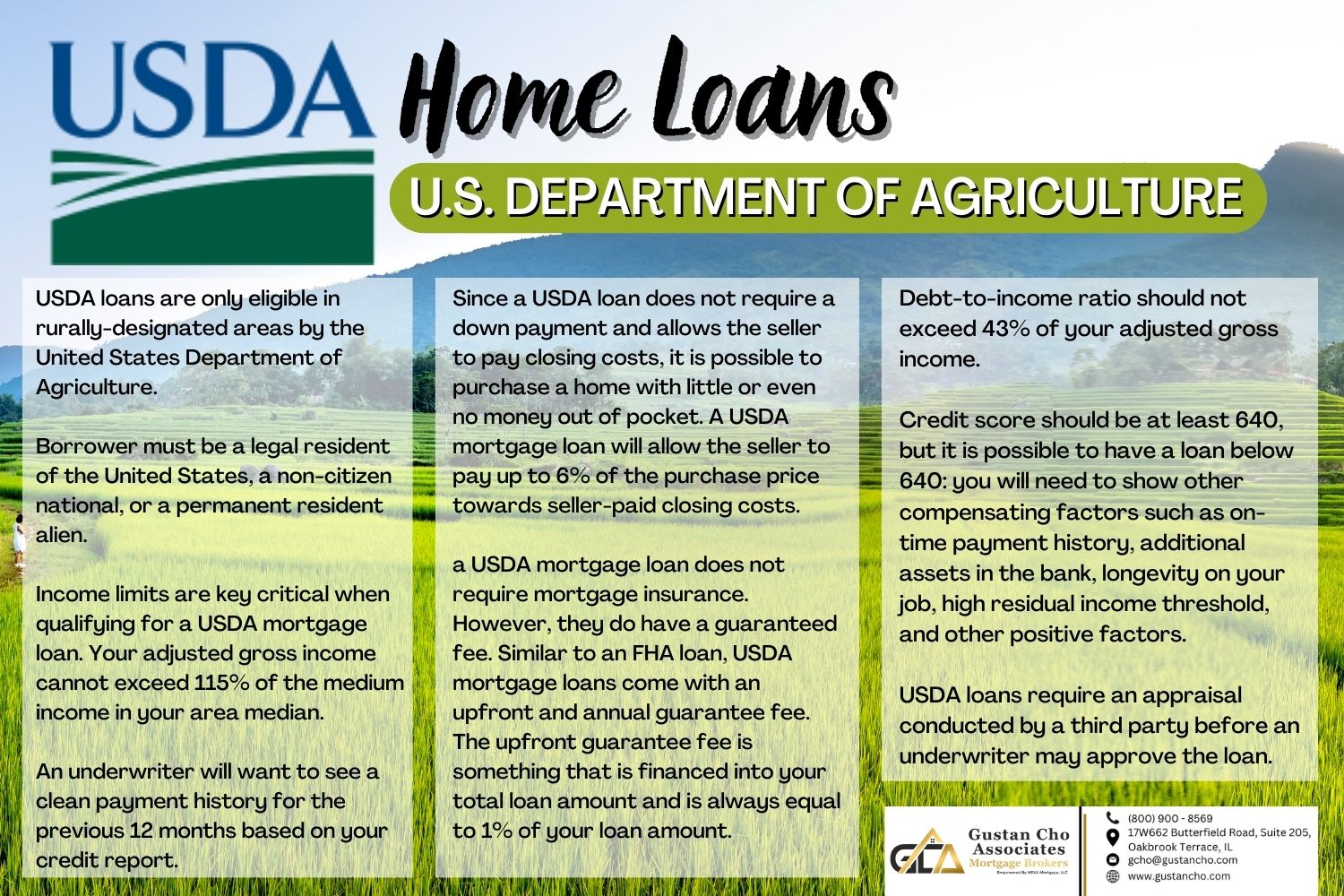

The borrowed funds try secured because of the USDA, and allows homeowners purchasing that have zero currency off. Really the only downside to this program is that you can not inhabit a local otherwise a densely inhabited city. Most section outside of locations qualify for it program. The new USDA features an internet site you could lookup to help you find out if the town and you will household we need to pick is qualified to receive this option.

Since RD system is a zero-money-off system, the sole money you need is actually for settlement costs and you will expenses. For folks who framework the deal you make toward a property properly, a share otherwise all of those will set you back are going to be reduced because of the the vendor.

Many people, plus particular loan providers, think about the USDA program tough to run. It simply is not! You just need to understand what the principles are. The application is made for reasonable to lessen income homeowners very you’ll find earnings restrictions. Yet not, such limitations are seemingly higher for many potential house customers. The fresh USDA and necessitates that the property enter good shape. This type of conditions should be be sure to are to buy property that does not you prefer people major repairs and won’t perspective one potential risks for you as the a purchaser. Exactly who does not want a safe house?

Virtual assistant Finance Various other zero-money-off system is the Pros Facts (VA) financing program. An experienced really needs a certification out-of qualification to see if they’re eligible to utilize this system and to influence exactly how much he’s eligible for. New Va claims the mortgage to a certain amount into bank which enables the financial institution so that the latest debtor to get $0 down if they are purchasing.

Brand new Va and you will RD financing applications try equivalent in this each other ensure it is no currency off and allow the seller to invest closing will cost you and you will pre-paid expenses. One another apps keeps minimum assets standards that will manage your house visitors of to find a detrimental possessions. In lieu of this new RD system, the fresh Va has no constraints regarding where an experienced can acquire a house.

FHA Loans in the Federal Construction Administrations program You can find very few low down fee applications that really work as well as the 3.5% down FHA program. The application form is similar to the RD and Virtual assistant applications. Area of the highlights of this choice are:

No geographic limits such as for instance RD Zero income limits Settlement costs and you may Costs are reduced by the Provider up to help you 6%of one’s purchase price Reasonable assets criteria to protect the buyer and you can FHA Program has actually specifications to have a low-renter co-signer Blemished credit doesn’t disqualify the new borrower Large loans in order to earnings percentages permitted to assist borrowers qualify Down payment will come away from something special or out-of a retirement membership Program allows the acquisition of 1-cuatro nearest and dearest characteristics

The newest FHA-NHHFA system offers good step 3% Bucks Guidance Give out of NHHFA (The Hampshire my company Houses Funds Expert)

If you don’t must live in an outlying urban area, commonly an experienced, and don’t have very enough currency on the 3.5% deposit that have FHA, there is the FHA-NHHFA system. In case the Seller believes to spend all the Closing costs and you will Pre-reduced expenditures, you could pick a property with a little a good ?% down.

An informed system for you. To determine what zero off or lowest money off program works best for you, name Charley Farley now on 603-471-9300.